Secrets to Interrupting Foreclosure Master Training

Stop Foreclosure FAST & Take Back Control of Your Property!

Your lender has a plan for your home—shouldn’t you have one too?

Want To Learn How To Stop Foreclosure INSTANTLY?

Are you facing foreclosure or struggling to keep up with your mortgage? Please don’t wait until it’s too late. In this powerful free training, you’ll uncover the hidden options most lenders won’t tell you about—strategies that can protect your home, give you time, and put you back in control.

You’ll learn:

How to identify the solutions that actually work in today’s market

Insider tactics to negotiate with your lender

The common mistakes homeowners make—and how to avoid them

Real steps to stop foreclosure and save your home

Knowledge is power, and this training provides you with the roadmap your bank hopes you will never discover.

👉 Sign up now—your home, your family, and your future are worth it.

Less Than 37 Days to Foreclosure? Here’s What You MUST Do Now

👉 Don’t wait until it’s too late—every day counts. Book your FREE 30-minute consultation today and discover the strategies that can stop foreclosure, protect your rights, and give you real options before the clock runs out.

Secrets to Interrupting Foreclosure Master Training

Stop Foreclosure FAST & Take Back Control of Your Property!

"Your lender has a plan for your home—shouldn’t you have one too?"

Want To Learn How To Stop Foreclosure INSTANTLY?

Are you facing foreclosure or struggling to keep up with your mortgage? Please don’t wait until it’s too late. In this powerful free training, you’ll uncover the hidden options most lenders won’t tell you about—strategies that can protect your home, give you time, and put you back in control.

You’ll learn:

How to identify the solutions that actually work in today’s market

Insider tactics to negotiate with your lender

The common mistakes homeowners make—and how to avoid them

Real steps to stop foreclosure and save your home

Knowledge is power, and this training provides you with the roadmap your bank hopes you will never discover.

👉 Sign up now—your home, your family, and your future are worth it.

Less Than 37 Days to Foreclosure? Here’s What You MUST Do Now

👉 Don’t wait until it’s too late—every day counts. Book your FREE 30-minute consultation today and discover the strategies that can stop foreclosure, protect your rights, and give you real options before the clock runs out.

Foreclosure is not the end—it’s a turning point.

Across the nation, foreclosure rates have been on the rise. In fact, foreclosure filings have surged over 15% year-over-year, with thousands of families losing their homes every single month.

But here’s the truth:

Foreclosure can be interrupted, delayed, and even stopped—if you know the right steps.

That’s exactly what you’ll discover in my groundbreaking training, Secrets to Interrupting Foreclosure.

What You’ll Learn Inside the Training

By enrolling, you’ll gain step-by-step strategies to:

✅ Understand the foreclosure process—and the key differences between judicial and non-judicial states.

✅ Discover proven legal and strategic methods to delay or stop foreclosure—even when your auction date is near.

✅ Navigate lender communication like a pro—so you’re never intimidated or blindsided again.

✅ Protect your rights as a homeowner while exploring loan modifications, short sales, and other options.

✅ Build a plan of action that puts you in control of your home, your finances, and your future.

Foreclosure is not the end—it’s a turning point.

Across the nation, foreclosure rates have been on the rise. In fact, foreclosure filings have surged over 15% year-over-year, with thousands of families losing their homes every single month.

But here’s the truth:

Foreclosure can be interrupted, delayed, and even stopped—if you know the right steps.

That’s exactly what you’ll discover in my groundbreaking training, Secrets to Interrupting Foreclosure.

What You’ll Learn Inside the Training

By enrolling, you’ll gain step-by-step strategies to:

✅ Understand the foreclosure process—and the key differences between judicial and non-judicial states.

✅ Discover proven legal and strategic methods to delay or stop foreclosure—even when your auction date is near.

✅ Navigate lender communication like a pro—so you’re never intimidated or blindsided again.

✅ Protect your rights as a homeowner while exploring loan modifications, short sales, and other options.

✅ Build a plan of action that puts you in control of your home, your finances, and your future.

“Your home doesn’t have to be another statistic—your fight isn’t over until you decide it is.”

“When the banks push, we push back—with knowledge, strategy, and power.”

“Foreclosure is temporary. Stability is possible. Victory is yours.”

Judicial vs. Non-Judicial Foreclosure: What You Must Know

Judicial Foreclosure: Your lender must take you to court before foreclosing. This gives you opportunities to respond, fight, and use legal strategies.

Non-Judicial Foreclosure: In certain states, banks can foreclose without court involvement—making the process faster and more aggressive. Your home is auctioned at a public venue.

Secrets to Interrupting Foreclosure shows you how to protect yourself in both situations.

“Your home doesn’t have to be another statistic—your fight isn’t over until you decide it is.”

“When the banks push, we push back—with knowledge, strategy, and power.”

“Foreclosure is temporary. Stability is possible. Victory is yours.”

Judicial vs. Non-Judicial Foreclosure: What You Must Know

Judicial Foreclosure: Your lender must take you to court before foreclosing. This gives you opportunities to respond, fight, and use legal strategies.

Non-Judicial Foreclosure: In certain states, banks can foreclose without court involvement—making the process faster and more aggressive. Your home is auctioned at a public venue.

Secrets to Interrupting Foreclosure shows you how to protect yourself in both situations.

MEET THE FOUNDER & CEO

Hey, I'm David Washington!

No matter what brought you here—whether it was one of my foreclosure prevention trainings, a previous short sale success story, or if this is your very first visit—I want to welcome you personally.

I’m David Washington, and through Kiplan Realty Group, LLC, we’ve developed powerful programs designed to tackle today’s toughest real estate challenges, including foreclosure prevention, loan modifications, short sales, divorce and property disputes, real estate investing, and more.

Licensed Real Estate Broker - REALTOR

Certified Distressed Property Expert

Certified Dispute Mediator

MEET THE FOUNDER & CEO

Hey, I'm David Washington!

No matter what brought you here—whether it was one of my foreclosure prevention trainings, a previous short sale success story, or if this is your very first visit—I want to welcome you personally.

I’m David Washington, and through Kiplan Realty Group, LLC, we’ve developed powerful programs designed to tackle today’s toughest real estate challenges, including foreclosure prevention, loan modifications, short sales, divorce and property disputes, real estate investing, and more.

Licensed Real Estate Broker - REALTOR

Certified Distressed Property Expert

Certified Dispute Mediator

About Our Trained Master Coaches

Our Master Coaches aren’t just advisors—they are highly trained specialists handpicked and personally trained by David Washington. Each coach has mastered the strategies of foreclosure prevention, short sales, loan modifications, and real estate crisis management.

They combine technical expertise with compassion, guiding homeowners step-by-step through the most difficult financial and legal challenges.

With years of hands-on experience and advanced training, our coaches don’t just give advice—they equip you with proven tools, strategies, and insider knowledge that banks and lenders don’t want you to know.

When you work with a Master Coach, you’re not facing foreclosure or financial stress alone—you have a trusted expert dedicated to helping you protect your home, your family, and your future.

About Our Trained Master Coaches

Our Master Coaches aren’t just advisors—they are highly trained specialists handpicked and personally trained by David Washington. Each coach has mastered the strategies of foreclosure prevention, short sales, loan modifications, and real estate crisis management.

They combine technical expertise with compassion, guiding homeowners step-by-step through the most difficult financial and legal challenges.

With years of hands-on experience and advanced training, our coaches don’t just give advice—they equip you with proven tools, strategies, and insider knowledge that banks and lenders don’t want you to know.

When you work with a Master Coach, you’re not facing foreclosure or financial stress alone—you have a trusted expert dedicated to helping you protect your home, your family, and your future.

Watch This Video

Foreclosure Doesn’t Have to Mean the End—Discover Your Alternatives Before It’s Too Late.

A free training designed to show homeowners the real options banks don’t want you to know about—and how to take back control of your home.

If you’re facing foreclosure, you may feel like you’re out of options. The truth is—you still have choices, but only if you act before the auction clock runs out.

This free training reveals proven foreclosure alternatives that can help you interrupt the process, protect your family, and open doors the bank would rather keep shut.

Stop Foreclosure Before It’s Too Late: Discover Your Real Options Now

This free training will open your eyes to what’s possible—but if you’re serious about stopping foreclosure, protecting your home, and taking full control of the process, enroll in the Secrets to Interrupting Foreclosure Master Training.

Inside, you’ll get the exact step-by-step system, templates, and coaching support that have helped homeowners just like you stop foreclosure—even when the sale date was days away.

Q & A's

“Is it really possible to stop a foreclosure this late in the process?”

Yes. Foreclosure is not final until the auction takes place. With the right strategy—whether it’s legal intervention, lender negotiations, or structured alternatives—you can interrupt the process and buy yourself critical time.

“What if I’ve already been denied for a loan modification?”

Being denied once does not mean you’re out of options. Lenders often say “no” the first time, but with the right documentation, negotiation strategy, or legal pathway, that “no” can turn into a “yes.”

“I’m overwhelmed—what if I don’t know where to start?”

That’s exactly why we created this training. You’ll get a clear, step-by-step roadmap of foreclosure alternatives so you’ll know exactly what actions to take and when. No guessing, no confusion—just a proven plan.

“Why shouldn’t I just walk away and let the bank take the house?”

Walking away guarantees the bank wins and often leaves you with damaged credit, possible debt, and zero control. By taking action, you create opportunities to save your home, protect your credit, and exit on your terms—not the lender’s.

“What’s the difference between the free training and the Secrets to Interrupting Foreclosure Master Training?”

The free training gives you the knowledge of what foreclosure alternatives exist and how they work. The Secrets to Interrupting Foreclosure Master Training gives you the step-by-step system, templates, and coaching support to put those strategies into action—and actually stop foreclosure.

Watch This Video

Stop Foreclosure Before It’s Too Late: Discover Your Real Options Now

This free training will open your eyes to what’s possible—but if you’re serious about stopping foreclosure, protecting your home, and taking full control of the process, enroll in the Secrets to Interrupting Foreclosure Master Training.

Inside, you’ll get the exact step-by-step system, templates, and coaching support that have helped homeowners just like you stop foreclosure—even when the sale date was days away.

Q & A's

“Is it really possible to stop a foreclosure this late in the process?”

Yes. Foreclosure is not final until the auction takes place. With the right strategy—whether it’s legal intervention, lender negotiations, or structured alternatives—you can interrupt the process and buy yourself critical time.

“What if I’ve already been denied for a loan modification?”

Being denied once does not mean you’re out of options. Lenders often say “no” the first time, but with the right documentation, negotiation strategy, or legal pathway, that “no” can turn into a “yes.”

“I’m overwhelmed—what if I don’t know where to start?”

That’s exactly why we created this training. You’ll get a clear, step-by-step roadmap of foreclosure alternatives so you’ll know exactly what actions to take and when. No guessing, no confusion—just a proven plan.

“Why shouldn’t I just walk away and let the bank take the house?”

Walking away guarantees the bank wins and often leaves you with damaged credit, possible debt, and zero control. By taking action, you create opportunities to save your home, protect your credit, and exit on your terms—not the lender’s.

“What’s the difference between the free training and the Secrets to Interrupting Foreclosure Master Training?”

The free training gives you the knowledge of what foreclosure alternatives exist and how they work. The Secrets to Interrupting Foreclosure Master Training gives you the step-by-step system, templates, and coaching support to put those strategies into action—and actually stop foreclosure.

Book Your Free 30-Minute Consultation Today

Struggling with foreclosure, divorce, or overwhelming mortgage challenges? Don’t wait until it’s too late—discover the options available to protect your home and your future.

✅ Learn your rights.

✅ Understand your options.

✅ Get expert guidance tailored to your situation.

👉 Schedule your FREE 30-minute consultation now and take the first step toward peace of mind.

PRICING

Your Foreclosure Solution Starts Here

Full Course Access – Self-Paced

✅ One-Time Investment

📚 Lifetime Access to All Training Modules

$497.95

Step-by-Step Blueprint – How to interrupt foreclosure in judicial & non-judicial states. Foreclosure timeline breakdowns & state-by-state strategies.

Lender Tactics Revealed – Spot the tricks banks use and fight back. Checklists, action plans, and document guides.

Legal Pathways – Simple guidance on court options & emergency motions. Bonus: How to spot lender & attorney mistakes (and use them in your favor).

Templates & Scripts – Ready-to-use docs for lenders, courts, and attorneys.

37-Day Rule Explained – Know your rights before and after the deadline.

Backup Strategies – Loan mods, short sales, and exits on your terms.

We guarantee you’ll gain the strategies and tools to fight foreclosure with confidence.

Full Course + Coaching Support

✅ Premium Access + Weekly Live Coaching Calls

🧠 Personalized Support with a Foreclosure Strategist

Step-by-Step Blueprint – How to interrupt foreclosure in judicial & non-judicial states. Foreclosure timeline breakdowns & state-by-state strategies.

Lender Tactics Revealed – Spot the tricks banks use and fight back. Checklists, action plans, and document guides.

Legal Pathways – Simple guidance on court options & emergency motions. Bonus: How to spot lender & attorney mistakes (and use them in your favor).

Templates & Scripts – Ready-to-use docs for lenders, courts, and attorneys.

37-Day Rule Explained – Know your rights before and after the deadline.

Backup Strategies – Loan mods, short sales, and exits on your terms.

Receive one-on-one strategy sessions tailored to your situation.

Get expert feedback on all documents and communications with lenders or attorneys.

Navigate court and legal options with confidence, using our network of paralegals and law firms.

Learn exactly what to say (and what not to say) when dealing with lenders.

Have a backup plan ready if your first option doesn’t work, including loan mods, short sales, or other solutions.

Ideal if your auction is coming fast, your situation is complicated, or you want peace of mind knowing you have expert backup.

Book Your Free 30-Minute Consultation Today

Struggling with foreclosure, divorce, or overwhelming mortgage challenges? Don’t wait until it’s too late—discover the options available to protect your home and your future.

✅ Learn your rights.

✅ Understand your options.

✅ Get expert guidance tailored to your situation.

👉 Schedule your FREE 30-minute consultation now and take the first step toward peace of mind.

PRICING

Your Foreclosure Solution Starts Here

Full Course Access – Self-Paced

FULL COURSE

✅ One-Time Investment

📚 Lifetime Access to All Training Modules

$497.95

Step-by-Step Blueprint – How to interrupt foreclosure in judicial & non-judicial states. Foreclosure timeline breakdowns & state-by-state strategies.

Lender Tactics Revealed – Spot the tricks banks use and fight back. Checklists, action plans, and document guides.

Legal Pathways – Simple guidance on court options & emergency motions. Bonus: How to spot lender & attorney mistakes (and use them in your favor).

Templates & Scripts – Ready-to-use docs for lenders, courts, and attorneys.

37-Day Rule Explained – Know your rights before and after the deadline.

Backup Strategies – Loan mods, short sales, and exits on your terms.

We guarantee you’ll gain the strategies and tools to fight foreclosure with confidence.

Full Course + Coaching Support

✅ Premium Access + Weekly Live Coaching Calls

🧠 Personalized Support with a Foreclosure Strategist

Step-by-Step Blueprint – How to interrupt foreclosure in judicial & non-judicial states.Foreclosure timeline breakdowns & state-by-state strategies.

Lender Tactics Revealed – Spot the tricks banks use and fight back. Checklists, action plans, and document guides.

Legal Pathways – Simple guidance on court options & emergency motions.Bonus: How to spot lender & attorney mistakes (and use them in your favor).

Templates & Scripts – Ready-to-use docs for lenders, courts, and attorneys.

37-Day Rule Explained – Know your rights before and after the deadline.

Backup Strategies – Loan mods, short sales, and exits on your terms.

Receive one-on-one strategy sessions tailored to your situation.

Get expert feedback on all documents and communications with lenders or attorneys.

Navigate court and legal options with confidence, using our network of paralegals and law firms.

Learn exactly what to say (and what not to say) when dealing with lenders.

Have a backup plan ready if your first option doesn’t work, including loan mods, short sales, or other solutions.

Ideal if your auction is coming fast, your situation is complicated, or you want peace of mind knowing you have expert backup.

Why This Course

Why It’s Vital to Stop Your Foreclosure Sale NOW

Time is NOT on Your Side – Once your property is auctioned, it’s gone—act before it’s too late!

Stay in Control of Your Home or Business – Stopping the foreclosure gives you time to explore OTHER options

Save Your Equity – Many properties have hidden equity that foreclosure wipes out instantly

Legal & Financial Options Exist – Foreclosure isn’t the end—there are legal strategies to stop the sale and regain stability

What You'll Learn

How to Legally Stop a Foreclosure Sale—Even at the Last Minute

Judicial vs. Non-Judicial Foreclosure: Your Rights & Options

Powerful Foreclosure Delay & Interruption Strategies

Loan Modifications, Forbearance, & Other Lender Workouts

How to Protect Commercial, Residential, Business & Rural Properties

Why This Course

Why It’s Vital to Stop Your Foreclosure Sale NOW

Time is NOT on Your Side – Once your property is auctioned, it’s gone—act before it’s too late!

Stay in Control of Your Home or Business – Stopping the foreclosure gives you time to explore OTHER options

Save Your Equity – Many properties have hidden equity that foreclosure wipes out instantly

Legal & Financial Options Exist – Foreclosure isn’t the end—there are legal strategies to stop the sale and regain stability

What You'll Learn

How to Legally Stop a Foreclosure Sale—Even at the Last Minute

Judicial vs. Non-Judicial Foreclosure: Your Rights & Options

Powerful Foreclosure Delay & Interruption Strategies

Loan Modifications, Forbearance, & Other Lender Workouts

How to Protect Commercial, Residential, Business & Rural Properties

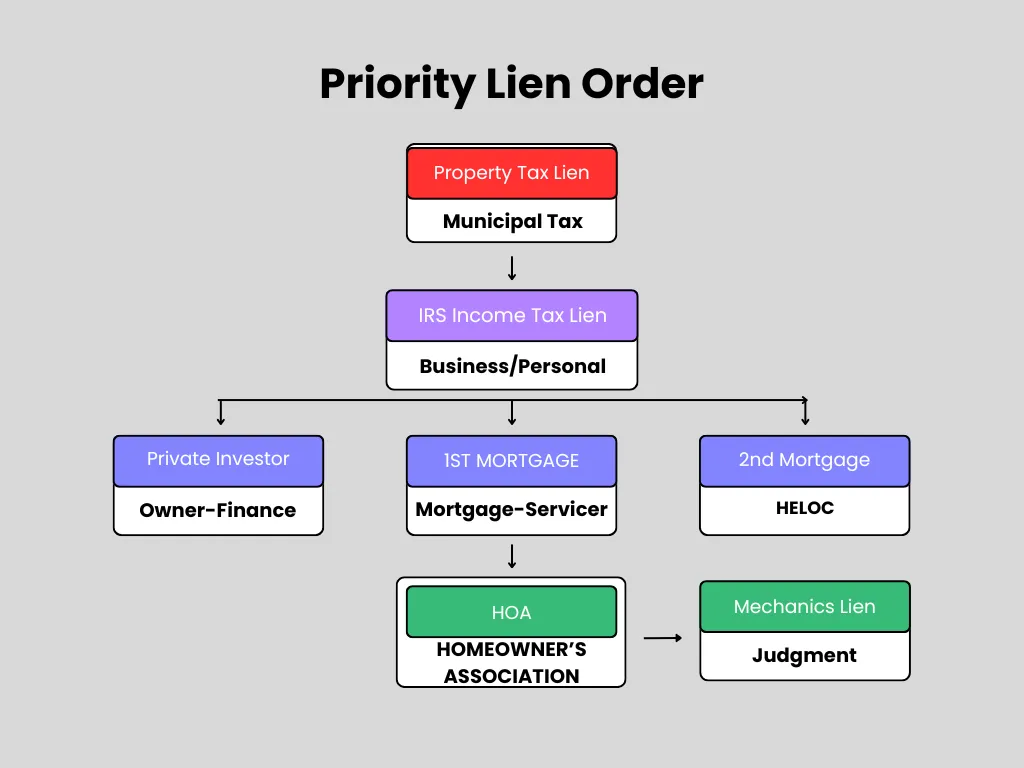

Who Can Foreclosure On Your Home?

Who Can Foreclosure On Your Home?

The Priority Lien Order

Mortgage Lender / Bank

The primary lender who gave you the mortgage has the legal right to foreclose if you default on payments.

Could be a traditional bank, credit union, or online lender.

Loan Servicer

The company that collects your monthly mortgage payments may be different from the original lender.

They often initiate foreclosure proceedings on behalf of the loan owner/investor.

Private Investor or Trust, including securitized loans

If your loan was sold into a mortgage-backed security (MBS), the trustee of that investment trust technically owns your loan.

The trustee or servicing company can start foreclosure.

Homeowners Association (HOA), Condo Association

If you live in an HOA or condo community and fall behind on dues or special assessments, the HOA/COA can place a lien and foreclose—sometimes even if your mortgage is current.

Second Mortgage or Home Equity Lender

If you have a second mortgage, home equity loan, or line of credit (HELOC), that lender can foreclose if you default, though they are usually in "second position" behind the first mortgage.

Property Tax Authority

If you fail to pay property taxes, your county or municipality can foreclose through a tax lien sale.

IRS or State Tax Authority

Federal or state governments can place liens and, in some cases, foreclose due to unpaid income or property-related taxes.

Mechanics or Judgment Lien Holders

Contractors, creditors, or others who have placed a legal lien on your property through court judgments may pursue foreclosure in some states.

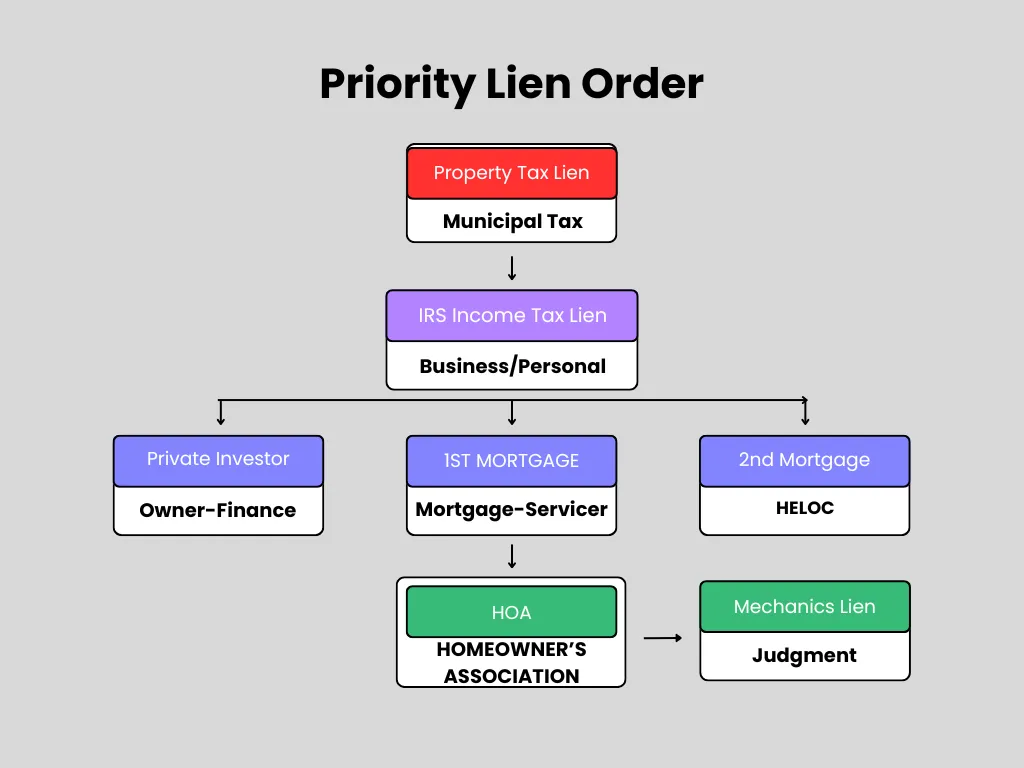

The Priority Lien Order

Mortgage Lender / Bank

The primary lender who gave you the mortgage has the legal right to foreclose if you default on payments.

Could be a traditional bank, credit union, or online lender.

Loan Servicer

The company that collects your monthly mortgage payments may be different from the original lender.

They often initiate foreclosure proceedings on behalf of the loan owner/investor.

Private Investor or Trust, including securitized loans

If your loan was sold into a mortgage-backed security (MBS), the trustee of that investment trust technically owns your loan.

The trustee or servicing company can start foreclosure.

Homeowners Association (HOA), Condo Association

If you live in an HOA or condo community and fall behind on dues or special assessments, the HOA/COA can place a lien and foreclose—sometimes even if your mortgage is current.

Second Mortgage or Home Equity Lender

If you have a second mortgage, home equity loan, or line of credit (HELOC), that lender can foreclose if you default, though they are usually in "second position" behind the first mortgage.

Property Tax Authority

If you fail to pay property taxes, your county or municipality can foreclose through a tax lien sale.

IRS or State Tax Authority

Federal or state governments can place liens and, in some cases, foreclose due to unpaid income or property-related taxes.

Mechanics or Judgment Lien Holders

Contractors, creditors, or others who have placed a legal lien on your property through court judgments may pursue foreclosure in some states.

👉 In short: It’s not just the bank

Mortgage lenders, HOAs, tax authorities, and even secondary lien holders can all initiate foreclosure depending on the type of debt owed.

👉 In short: It’s not just the bank

Mortgage lenders, HOAs, tax authorities, and even secondary lien holders can all initiate foreclosure depending on the type of debt owed.

Foreclosure Is Over—But You Haven’t Moved Out Yet. Now What?

What Happens If You Stay in Your Home After Foreclosure?

The Auction Takes Place

Once your home is foreclosed, it’s typically sold at a public auction. The winning bidder may be the bank (lender) or a third-party buyer.

You Are No Longer the Owner

The foreclosure sale transfers ownership. Even if you’re still living there, you legally no longer own the property.

You May Receive an Eviction Notice

If the new owner wants possession, they must follow state eviction procedures. This usually begins with a written notice to vacate, giving you a set number of days to move.

The Eviction Process Begins

If you don’t leave voluntarily, the new owner (or the bank) will file an eviction lawsuit.

If they win in court, a sheriff or constable will be authorized to remove you from the property.

Deficiency Judgment Risk

In some states, if the foreclosure sale price didn’t cover the full mortgage balance, the lender may still pursue you for the remaining debt (called a deficiency judgment).

Credit Damage and Waiting Periods

Foreclosure remains on your credit report for up to 7 years, impacting your ability to get new housing, loans, or credit.

There are also waiting periods before you can qualify for another mortgage.

Possibility of Cash for Keys

Sometimes, lenders or investors offer “cash for keys,” where they pay you to leave quickly and in good condition, avoiding the cost of eviction.

Watch This Video

Foreclosure and Eviction: What to Expect If You Don’t Leave

In short: Staying after foreclosure doesn’t stop the process. You lose ownership at auction, and if you don’t leave voluntarily, eviction follows.

BOOK MY IMMEDIATE APPOINTMENT!

Foreclosure Is Over

But You Haven’t Moved Out Yet. Now What?

What Happens If You Stay in Your Home After Foreclosure?

The Auction Takes Place

Once your home is foreclosed, it’s typically sold at a public auction. The winning bidder may be the bank (lender) or a third-party buyer.

You Are No Longer the Owner

The foreclosure sale transfers ownership. Even if you’re still living there, you legally no longer own the property.

You May Receive an Eviction Notice

If the new owner wants possession, they must follow state eviction procedures. This usually begins with a written notice to vacate, giving you a set number of days to move.

The Eviction Process Begins

If you don’t leave voluntarily, the new owner (or the bank) will file an eviction lawsuit.

If they win in court, a sheriff or constable will be authorized to remove you from the property.

Deficiency Judgment Risk

In some states, if the foreclosure sale price didn’t cover the full mortgage balance, the lender may still pursue you for the remaining debt (called a deficiency judgment).

Credit Damage and Waiting Periods

Foreclosure remains on your credit report for up to 7 years, impacting your ability to get new housing, loans, or credit.

There are also waiting periods before you can qualify for another mortgage.

Possibility of Cash for Keys

Sometimes, lenders or investors offer “cash for keys,” where they pay you to leave quickly and in good condition, avoiding the cost of eviction.

Watch This Video

Foreclosure and Eviction: What to Expect If You Don’t Leave

In short: Staying after foreclosure doesn’t stop the process. You lose ownership at auction, and if you don’t leave voluntarily, eviction follows.

BOOK MY IMMEDIATE APPOINTMENT!

TESTIMONIALS

What Others Are Saying

“I was 10 days from foreclosure when I found this program. Not only did I stop the sale, but I also got a loan modification that made my payments affordable!” – James P.

“I was losing my business property to foreclosure, but this training helped me keep it and negotiate better terms with my lender!” – Michelle R.

“They told me I had no options, but this training proved them wrong! I was able to stop my foreclosure sale and even had time to sell my home for a profit.” – Carlos G.

⭐️ “This program is a must for anyone in foreclosure. It works in every state and gives you step-by-step guidance to stop the process legally!” – Karen D.

TESTIMONIALS

What Others Are Saying

“I was 10 days from foreclosure when I found this program. Not only did I stop the sale, but I also got a loan modification that made my payments affordable!” – James P.

“I was losing my business property to foreclosure, but this training helped me keep it and negotiate better terms with my lender!” – Michelle R.

“They told me I had no options, but this training proved them wrong! I was able to stop my foreclosure sale and even had time to sell my home for a profit.” – Carlos G.

⭐️ “This program is a must for anyone in foreclosure. It works in every state and gives you step-by-step guidance to stop the process legally!” – Karen D.

Want to work with us?

We are committed to empowering homeowners, buyers, and real estate professionals with the knowledge to take control of their financial futures.

COMPANY

CUSTOMER CARE

LEGAL

FOLLOW US

Copyright 2026. Kiplan Realty Group, LLC. All Rights Reserved.